When it comes to understanding the value of a property, two important terms often used are economic life and effective age. These concepts are essential in determining the worth of a real estate investment and can greatly affect its profitability.

In this post, we will explore what economic life and effective age mean, how they are calculated, and why they are important in the real estate industry.

What is Economic Life Real Estate?

Economic life real estate, also known as economic value, refers to the period that a property is expected to remain economically profitable. This concept is important in real estate valuation and investment decisions.

Understanding the economic life of a property is crucial for investors to determine if the property will generate enough cash flow to cover expenses and provide a return on investment.

What is the Example of Economic Life Real Estate?

For instance, an office building may have an estimated economic life of 40 years, meaning that it is expected to generate profits and be in use for at least 40 years before it becomes obsolete or requires major renovations. This information is important for investors to consider when deciding to buy or sell a property.

What Factors Affects the Economic Real Estate?

Physical deterioration: Physical deterioration refers to the wear and tear of a property over time due to usage, exposure to natural elements, and lack of maintenance. This can include outdated systems, repairs needed, or cosmetic updates that may be required to keep the property competitive.

Financial obsolescence:

Financial obsolescence is a reduction in valuedue to exterior factors such as changes in the surrounding area, economic conditions, or government regulations. For example, if a new highway is built near a property, its value may increase due to improved accessibility.

On the other hand, if a major employer in the area shuts down, it can decrease the demand for properties in that location.

Functional obsolescence:

Functional obsolescence occurs when a property is no longer suitable for its intended use. This could be due to technological changes, demographics, or design trends. For example, a building with multiple levels and no elevator may become less desirable as it becomes more difficult for people with mobility issues to access.

Location: The area of a property can greatly impact its economic life. A property in a desirable area with high demand will likely have a longer economic life than one in a less desirable location. Factors such as nearness to amenities, schools, transportation, and job opportunities can influence a property’s economic value.

Demand: The demand for a property is closely tied to its economic life. If there is high demand for properties in the area, it is more likely that the property will have a longer economic life and continue to generate profits. On the other hand, if there is high demand, the property may be able to maintain its value and economic viability.

Legal or regulatory changes: Changes in laws or regulations can also affect the economic life of a property. For example, new zoning laws or environmental regulations may require costly updates or repairs to the property, affecting its profitability. Investors must stay informed of potential changes that could impact their investments.

Competition: The level of competition in the market can also play a role in the economic life of a property. In areas with high competition, properties may need to be updated more frequently and offer competitive pricing to attract tenants and remain profitable. On the other hand, in areas with little competition, properties may have a longer economic life as they can maintain higher rental rates.

Inflation: Inflation can also impact the economic life of a property. As prices for goods and services increase, the cost to maintain and operate a property will also rise. This could decrease cash flow and profitability if rental rates stay the same rate.

Management: The management of a property can also affect its economic life. Effective property management can lead to cost-saving measures, tenant retention, and profitability. On the other hand, poor management can result in higher expenses and vacancies and ultimately decrease the economic life of a property.

What is a Effective Age in Real Estate?

Effective age, also known as functional age, refers to the perceived age of a property based on its condition and level of maintenance. It considers any updates or renovations done to the property and can differ from its actual age. This concept is commonly used in real estate appraisals and affects a property’s value and economic life.

What is the Example of Effective Age in Real Estate?

For example, a property may be 50 years old but has an effective age of 30 years due to recent renovations and maintenance. This can increase its economic life as it is perceived to be in better condition and more desirable compared to a property with the same actual age but a higher effective age.

How is Economic Life Real Estate Calculated?

The economic life of a property is typically calculated by subtracting its effective age from its estimated total economic life. For example, if a property has an estimated total economic life of 40 years and an effective age of 15, its remaining economic life would be 25 years.

Market conditions, location, and demand should also be considered when calculating the economic life.

Factors that can impact the effective age of a property include:

Regular maintenance and upkeep: If a property is well-maintained and regularly updated, it may have a younger effective age than its actual age. This can improve its value and economic life.

Renovations or improvements: Significant renovations or upgrades to a property can also decrease its effective age. For example, replacing outdated systems or modernizing the property’s design can make it more attractive to potential tenants and extend its economic life.

Wear and tear: As a property ages, it will naturally experience wear and tear. This can be addressed through regular maintenance and repairs, but if neglected, it can lead to a higher effective age and decrease the property’s value.

Material quality: The quality of materials used in construction can also impact a property’s effective age. For example, a property with high-quality materials may have a longer economic life than one with cheaper materials, which may deteriorate more quickly.

Location: The site of a property can also play a role in its effective age. Properties in areas prone to natural disasters or extreme weather conditions may experience more wear and tear, leading to an older effective age.

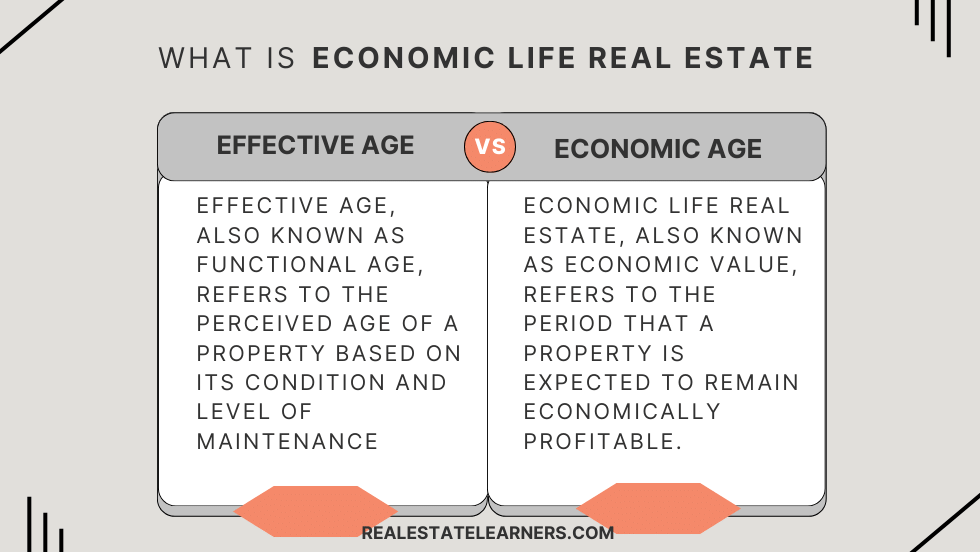

What is the Difference Between Economic Life and Effective Age?

Economic life refers to the total period in which a property is expected to be economically viable and generate profits. In contrast, effective age refers to the perceived age of a property founded on its condition and level of maintenance.

Economic life considers factors such as physical deterioration, financial obsolescence, functional obsolescence, location, demand, legal or regulatory changes, competition, inflation, and management. Effective age focuses on the condition and maintenance of the property.

Economic life is typically based on a predetermined period or number of years, while effective age can change over time as the property is maintained or renovated.

Economic life is used in real estate appraisals to determine a property’s value and potential profitability. In contrast, effective age is used to evaluate the condition and maintenance of a property.

While economic life can be influenced by external factors such as market trends and legal changes, effective age is primarily impacted by the actions and management of the property owner.

While economic life ultimately determines the viability and profitability of a property, maintaining a younger, effective age through regular maintenance and renovations can help extend its overall economic life.

Conclusion

In conclusion, understanding the concepts of economic life and effective age is crucial for making informed decisions in various industries such as real estate, construction, and accounting.

Knowing the expected lifespan of an asset canhelp determine its value and assess any potential risks or expenses that may arise in the future. Additionally, considering an asset’s effective age real estate can provide a more accurate picture of its current condition and potential for future use.

Corey has over 15 years of experience as a real estate broker and educator. He is dedicated to providing valuable insights and guidance for those looking to enter the real estate industry.